New Trump tariffs stoke inflation fears, trigger $2 billion in crypto liquidations, Bitcoin crashes to $92K

Key Takeaways

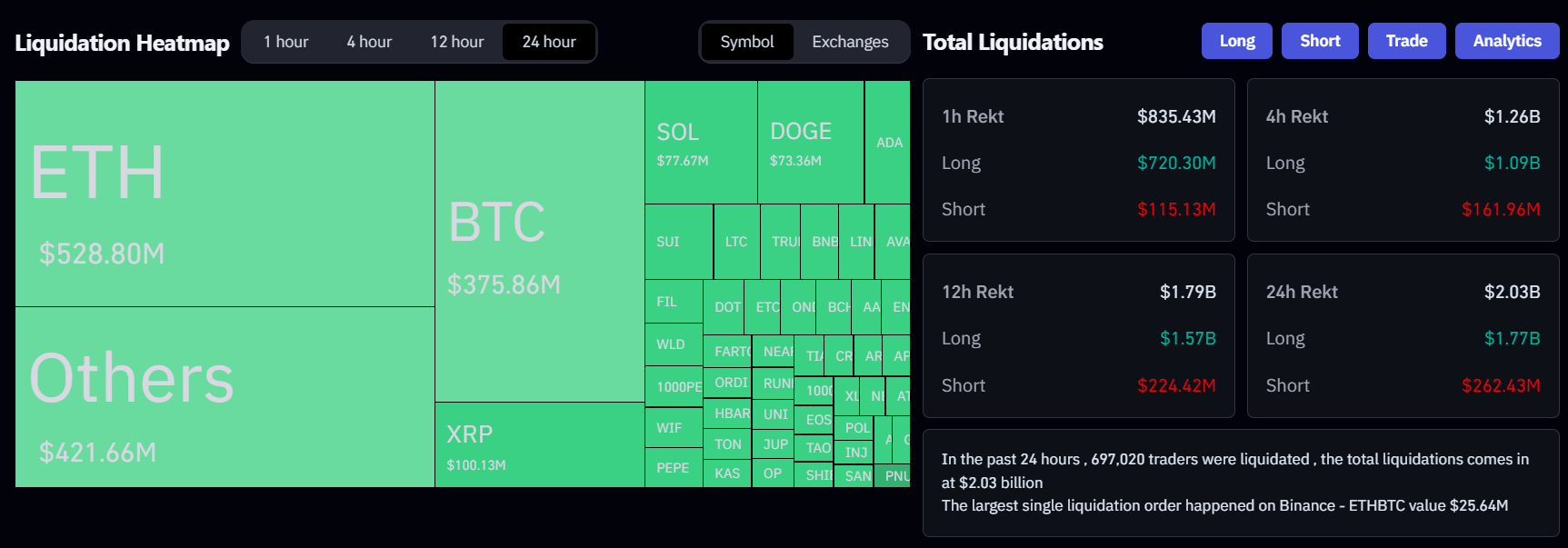

Crypto crash wiped out $2 billion in leverage liquidations in the last 24 hours.

Despite the recent decline, analysts suggest that a weaker dollar and lower US rates could create favorable conditions for Bitcoin adoption.

Share this article

Bitcoin’s fall to its lowest point since early January caused a massive wave of liquidations across crypto derivatives exchanges, totaling $2 billion. The brutal sell-off followed President Trump’s announcement of new tariffs that sparked inflation concerns, according to Coinglass data.

Trump on Saturday announced plans to impose a 25% tariff on imports from Canada and Mexico, along with a 10% tariff on Chinese goods. The measures, targeting America’s three largest trading partners, will take effect on Tuesday.

The President framed the tariffs as part of a broader strategy to address border security and combat the opioid crisis, particularly fentanyl trafficking.

Economists warn Trump’s new tariffs could increase consumer costs as businesses pass on additional expenses.

While the White House maintains these measures will strengthen American manufacturing, experts caution they could worsen inflation and potentially trigger a trade conflict affecting all nations involved, leading to job losses and supply chain disruptions.

The announcement of these tariffs has triggered volatility in the crypto market as investors reacted to fears of mounting inflationary pressures.

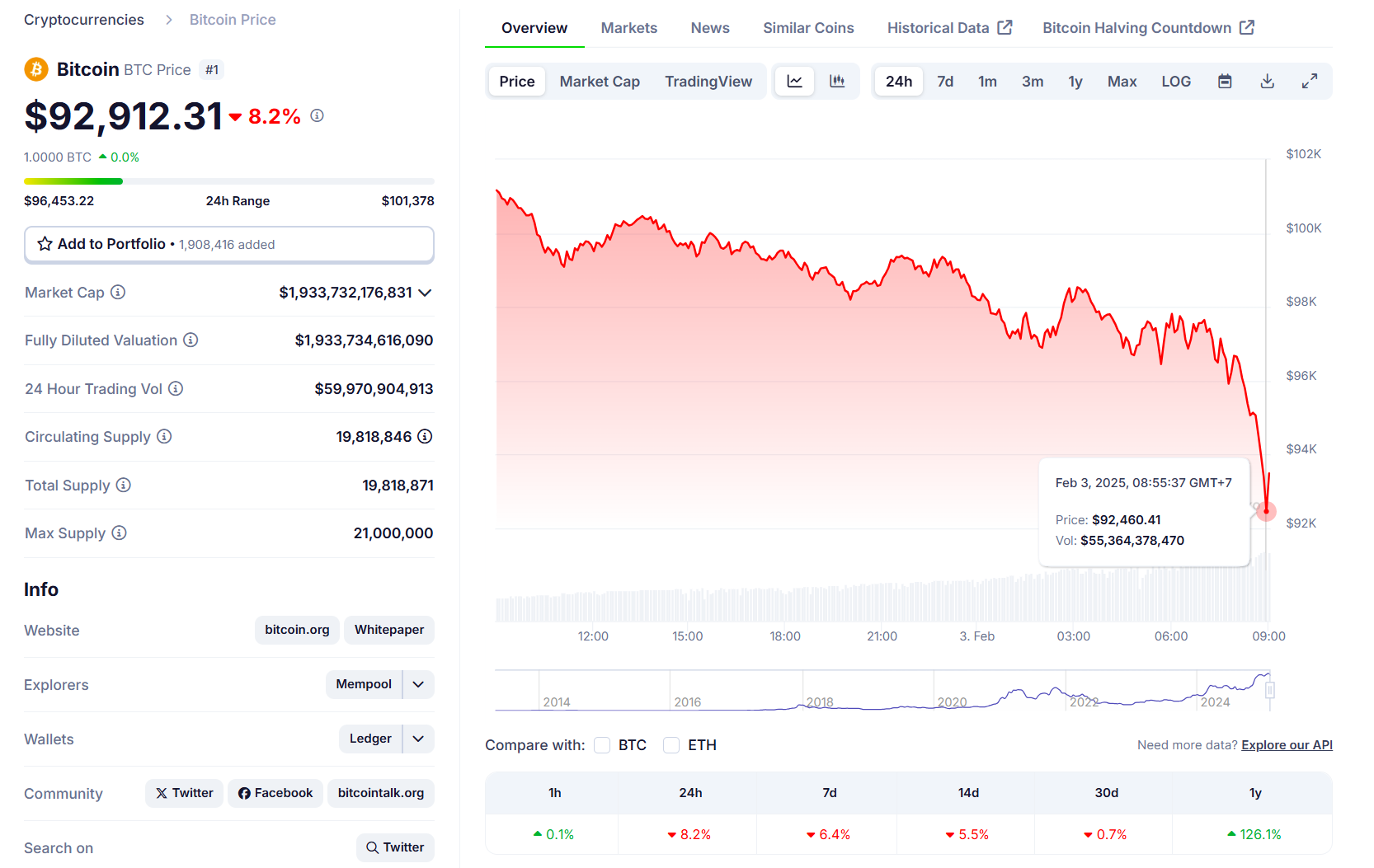

Bitcoin fell below $100,000 on Saturday and continued its decline to $92,000, while Ethereum dropped 24% to $2,300, according to CoinGecko data.

The market turbulence led to $1.7 billion in long position liquidations over 24 hours, with Ethereum traders experiencing $528 million in losses and Bitcoin traders facing $421 million in liquidations, Coinglass data shows.

The overall crypto market capitalization shrank by approximately 8%, with most crypto assets recording double-digit losses within a day. XRP and DOGE fell 30%, ADA declined 35%, while SOL and BNB each dropped 15%.

Trump’s tariffs will send Bitcoin prices higher, faster

Analysts believe that Trump’s new tariffs could lead to increased demand for Bitcoin as a hedge against inflation. Yet, many caution that ongoing market volatility may continue to pressure prices downward in the short term.

According to Jeff Park, head of alpha strategies at Bitwise Asset Management, Trump’s tariff policies could inadvertently set the stage for a Bitcoin boom.

This is the only thing you need to read about tariffs to understand Bitcoin for 2025. This is undoubtedly my highest conviction macro trade for the year: Plaza Accord 2.0 is coming.

Bookmark this and revisit as the financial war unravels sending Bitcoin violently higher. pic.twitter.com/WxMB36Yv8o

— Jeff Park (@dgt10011) February 2, 2025

The implementation of new tariffs could weaken the dollar and create conditions favorable for Bitcoin’s growth, Park suggests. This comes as the US grapples with the Triffin Dilemma, where its role as the global reserve currency requires maintaining trade deficits to provide worldwide liquidity.

The tariffs are viewed as a strategic move to temporarily weaken the dollar, potentially leading to a multilateral agreement similar to “Plaza Accord 2.0” that could reduce dollar dominance and encourage countries to diversify their reserves beyond US Treasuries.

The analyst indicates that the combination of a weaker dollar and lower US rates could create favorable conditions for Bitcoin adoption. As tariffs push inflation higher, affecting both domestic consumers and international trade partners, foreign nations may face currency debasement, potentially driving their citizens toward Bitcoin as an alternative store of value.

Both sides of the trade imbalance will seek refuge in Bitcoin, driving its price “violently higher,” Park said.

Share this article