What You Need To Know

When the House of Representatives gavels in today, the chamber will devote its entire floor schedule to what Republican leaders are calling “Crypto Week,” a coordinated push to vote on three high-profile digital-asset bills: the Senate-passed Genesis of Electronic Notes and Issuance Under Supervision (GENIUS) Act, the Anti-CBDC Surveillance State Act, and the Digital Asset Market Clarity (CLARITY) Act. Majority Leader Steve Scalise cast the moment in sweeping terms, saying the package “further[s] the President’s pro-growth and pro-business agenda, and provide[s] a clear regulatory framework for digital assets.”

The intra-Republican debate burst into the open late last week when Ohio Republican Warren Davidson warned in a post on X that the sequencing chosen by party leaders could backfire. “Crypto Week next week in the House,” he wrote on 11 July. “The Senate’s GENIUS Act to regulate stablecoins should be amended… Instead, they want to pass it without amendments… Without the CBDC ban, CBDC delivery architecture would be in place, and nothing would protect self-custody. For this reason, I will oppose the GENIUS Act.”

Davidson’s chief fear is that the narrower stablecoin bill will sail to the President’s desk while the broader market-structure and CBDC measures stall in the Senate, leaving what he calls a “hollowed-out” framework in place. The episode exposes a rift between members who prize incremental wins—especially a federal stablecoin statute many lobbyists have sought for years—and libertarian-leaning lawmakers who see a CBDC ban and explicit protections for self-hosted wallets as existential.

What Each Crypto Bill Does, And Where It Stands

Stablecoins. The GENIUS Act, which cleared the Senate 68-30 in June, would require any issuer of a crypto stablecoin to hold reserves “backed one-to-one by US currency or other similarly liquid assets” and to publish a monthly breakdown of those reserves. Because the bill has already passed the upper chamber, a clean House vote would send it directly to President Trump, who has publicly promised to sign it.

CBDCs. The Anti-CBDC Surveillance State Act (H.R. 1919) would prohibit the Federal Reserve from “using a central bank digital currency to implement monetary policy” and bar any Fed-issued retail CBDC altogether. The bill advanced from committee in May but lacks a Senate companion with the 60 votes needed to overcome a filibuster—precisely the bottleneck Davidson and other skeptics highlight.

Market structure. The 236-page CLARITY Act carves crypto assets into three buckets—securities, commodities, and “permitted payment stablecoins”—and removes the last two from the statutory definition of a security. Section-by-section summaries note that the measure directs the SEC and CFTC to write parallel rulebooks and creates provisional registration regimes for exchanges, brokers, and custodians. Unlike GENIUS, CLARITY has not yet been taken up in the Senate; Banking Committee Chair Tim Scott has promised a hearing “by the end of September,” but no legislative text exists in that chamber.

Democrats, who were pivotal in sending GENIUS through the Senate, are signaling sharper resistance in the House. Rep. Maxine Waters, the ranking Democrat on Financial Services, derided the GOP branding as “‘Anti-Crypto Corruption Week,’ calling all three bills dangerous pieces of crypto legislation.”

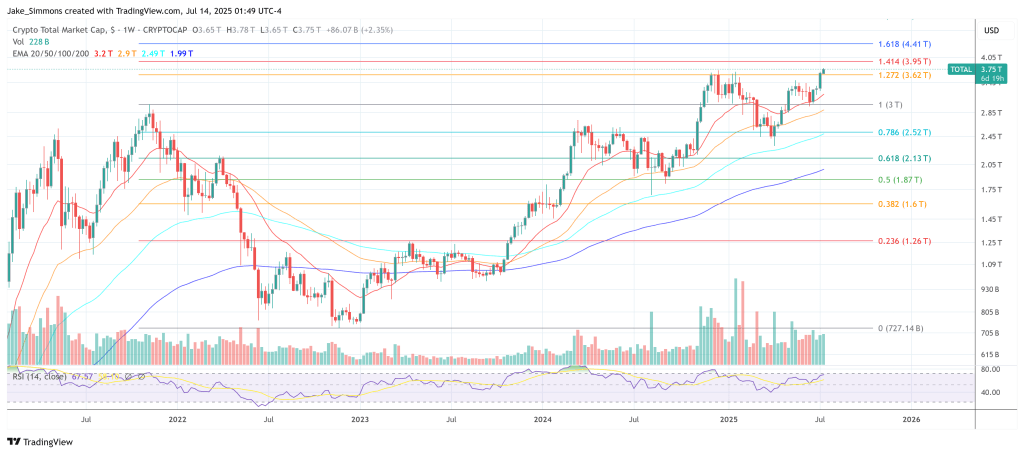

The legislative drumbeat has coincided with a fresh all-time-high in Bitcoin above $121,000 and a rally in altcoins. Independent trader Cas Abbé summed up the mood via X: “US House has designated July 14–18 as ‘crypto week’…It’s expected that all of them will be passed in 2025, which will set the stage for a massive rally.”

At press time, the total crypto market cap was at $3.75 trillion.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.