Joachim Nagel: Central Banks Need to Embrace Digital Currencies for Future Relevance

The president of the Bundesbank and a member of the European Central Bank (ECB), Joachim Nagel, emphasises the significance of central banks embracing technological innovation and implementing central bank digital currencies (CBDCs) in order to maintain their relevance in the future. This is in response to the fact that the financial environment is undergoing rapid change.

Nagel highlights the need of central banks modifying their business models and reacting to the altering payment environment in order to maintain their competitive edge. This is necessary in order for them to continue to survive. Central banks are needed to research new avenues in order to ensure that they continue to be relevant. This is because the usage of physical money is becoming less desirable.

Nagel lays a significant amount of stress on the importance of central banks using distributed ledger technology, like as blockchain, in order to facilitate the adoption of CBDCs. Using this technology, central banks have the opportunity to increase the efficiency of financial transactions, as well as the security and transparency of such transactions.

With regard to the doubt around Central Banks, Nagel acknowledges the fact that there is a great deal of doubt around central banks as a consequence of the advancements in technology and the fluctuating needs of customers. He lays a significant amount of emphasis on the need for central banks to “speed up” their adaptation to these changes, which in turn involves the adoption of CBDCs.

Potential Benefits of CBDCs CBDCs provide a variety of potential benefits, which may be enjoyed by proprietors of businesses as well as clients of such businesses. On the other hand, it would be advantageous for customers to have access to a European payment mechanism that is not only safe but also simple, speedy, reliable, and applicable throughout the whole of the euro area. It would be to the advantage of merchants to have more competition in the payments industry as well as speedy settlement, which is analogous to cash transactions.

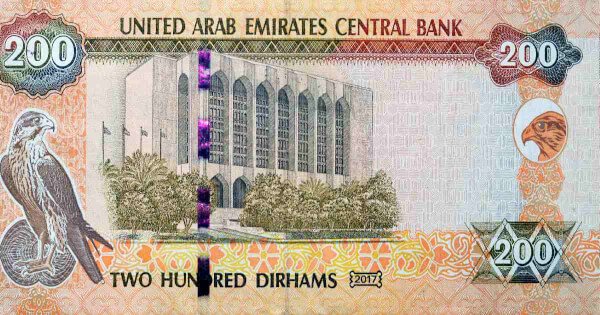

Image source: Shutterstock

. . .