BlackRock’s IBIT ETF Could Hit $100 Billion in July

BlackRock’s IBIT ETF (Exchange-Traded Fund) is turning heads amid a sustained growth in its net assets, with analysts saying it could reach $100 billion this month.

The financial instrument recently passed as the asset manager’s most profitable ETF, driving more revenue than BlackRock’s S&P 500 fund.

Can BlackRock’s IBIT Reach $100 Billion in Assets in July? Analyst Says Yes

ETF analyst Eric Balchunas said BlackRock’s IBIT ETF could reach $100 billion in net assets in July. The optimism comes amid consistent positive flows into the financial instrument as institutional investors seek indirect exposure to BTC via IBIT.

“I wrote last week that IBIT could hit $100 billion this summer, but hell, could be this month. Thx to recent flows + overnight rally it’s already at $88 billion,” wrote Balchunas.

Indeed, data on crypto investment research tool SoSoValue corroborates this outlook, showing a sustained growth in daily volume for BlackRock’s IBIT ETF.

As of July 14, IBIT’s net assets stood at $85.96 billion after sustained positive flows on every trading day since June 9.

Instances of negative flows, or outflows, are also isolated, with none in July, adding credence to Balchunas’ supposition that IBIT net assets value could hit $100 billion this month.

Meanwhile, reports indicate that IBIT is BlackRock’s most profitable ETF. More closely, it is the asset manager’s fastest financial instrument on growth metrics after breaching the $80 billion mark. It hit this milestone on July 11, only 374 days after its launch.

Beyond net assets, BlackRock’s IBIT is also the biggest ETF on revenue metrics, surpassing the asset manager’s S&P 500 ETF (IVV) as it generates $186 million annually. A notable reduction in IBIT’s volatility accentuates this traction, making it nearly as stable as the S&P 500.

Moreover, it is impossible to separate IBIT’s growth from Bitcoin’s surge, with the two assets enjoying a symbiotic relationship. On the one hand, IBIT gives institutional investors indirect access to Bitcoin via a regulated vehicle, culminating in a BTC price surge.

On the other hand, the growth in Bitcoin’s price directly benefits the asset manager’s net assets, as the value of IBIT rises in tandem.

This attracts more investor interest, boosting BlackRock’s assets under management (AuM), and therefore generating more fees. As its profitability increases, so does its dominance in the Bitcoin ETF race.

BlackRock Buys $386 Million Worth of Bitcoin

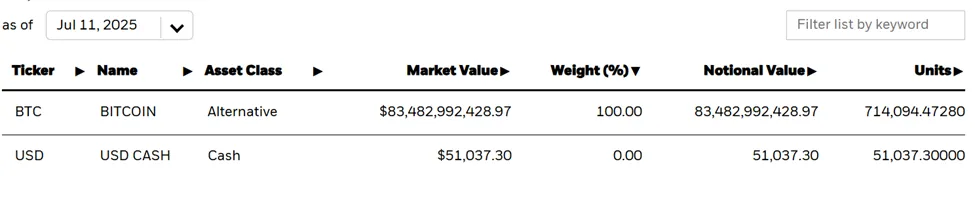

Elsewhere, BlackRock has added to its Bitcoin stockpile, acquiring an additional 3,294 BTC for $386 million.

The asset manager now holds 717,388 BTC tokens, with a notional value of $83.86 billion.

Against the backdrop of BlackRock’s Bitcoin accumulation spree, the asset manager is steadily nearing Satoshi Nakamoto’s BTC stash, estimated at 1.1 million BTC.

At its current clip, gobbling up around 40,000 BTC per month, or about 1,300 BTC daily, BlackRock’s IBIT is over 65% there.

According to Balchunas, BlackRock sustaining this pace could see its IBIT ETF surpass Satoshi by May 2026, just two years after its launch.

“…IBIT has gobbled up 40k BTC a month (or 1.3k/day) on pace to hit 1.2m in May ’26 (not bad for 2yr old infant),” Balchunas remarked.

For now, however, that fast growth makes IBIT the youngest member among the top 25 largest ETFs globally by assets under management. This is not a mean feat given IBIT’s establishment 2.1 years ago or 1.6 years since it started trading.

Alongside Bitcoin, BlackRock is ramping up on Ethereum (ETH), with reports indicating the latest purchase as 50,970.08 ETH worth $150 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.