Bitcoin ETFs Rebound With a $744 Million Weekly Inflow

After five weeks of consecutive outflows, US spot Bitcoin ETFs have rebounded with $744 million in net inflows this week. On Monday, March 17, ETFs saw a $274 million inflow, which was the highest daily figure in over a month.

This rebound suggests that institutional investors are coming back to the Bitcoin market as macroeconomic factors have priced in. However, BTC still remains below the $90,000 threshold.

Bitcoin ETFs Start Recovering from a $5 Billion Loss

US Bitcoin ETFs lost over $5.3 billion since the second week of February. The month was particularly brutal for ETFs, with a record-breaking $3.5 billion in outflows.

The sharp sell-off was attributed to institutional investors liquidating their holdings amid market volatility and shifting macroeconomic conditions. However, March has signaled a turnaround, with inflows steadily increasing over the past week.

With macroeconomic concerns easing, institutional investors appear to be regaining confidence in the market. The week began on a strong note, with Bitcoin ETFs recording $274 million in inflows on Monday.

The positive momentum persisted, culminating in six straight days of net inflows. On March 21 alone, the ETFs saw a total net inflow of $83.09 million.

BlackRock’s IBIT led the way, recording up to $150 million in positive flows on Friday. Meanwhile, all other issuers remained stagnant. The only outlier was Grayscale’s GBTC, which continued its trend of outflows, losing $21.9 million that day.

This shift suggests that institutional players may be positioning themselves for a potential market recovery. Crypto influencer and Open4Profit founder Zia ul Haque pointed to this resurgence, questioning whether institutional investors are acting on inside knowledge.

“Institutes started Accumulating Again: Do they know something?! Bitcoin ETF saw a positive inflow for the last consecutive 5 days! This is the major consecutive inflow this month. From the beginning of March, giants sold BTC heavily which created a massive panic and price dump in the market. But in the last few days, they are accumulating again. This could be a good sign for the market,” ul Haque wrote.

His observation aligns with the steady recovery in ETF inflows and Bitcoin’s price action, which continues to defend against further downside.

However, despite the positive ETF flows, not everyone shares the bullish outlook and optimism for Bitcoin’s price recovery. Some analysts think that Bitcoin ETF inflows do not clearly reflect resuming buyer interest.

Institutional trading strategies are potentially experiencing structural shifts. Hedge funds often leverage a low-risk arbitrage strategy involving Bitcoin spot ETFs and CME futures.

“The ETF ‘demand’ was real, but some of it was purely for arbitrage. There was a genuine demand for owning BTC, just not as much as we were led to believe. Until real buyers step in, this chop & volatility will continue,” popular analyst Kyle Chasse explained.

If this structural shift continues, it could influence market stability despite the recent return of ETF inflows.

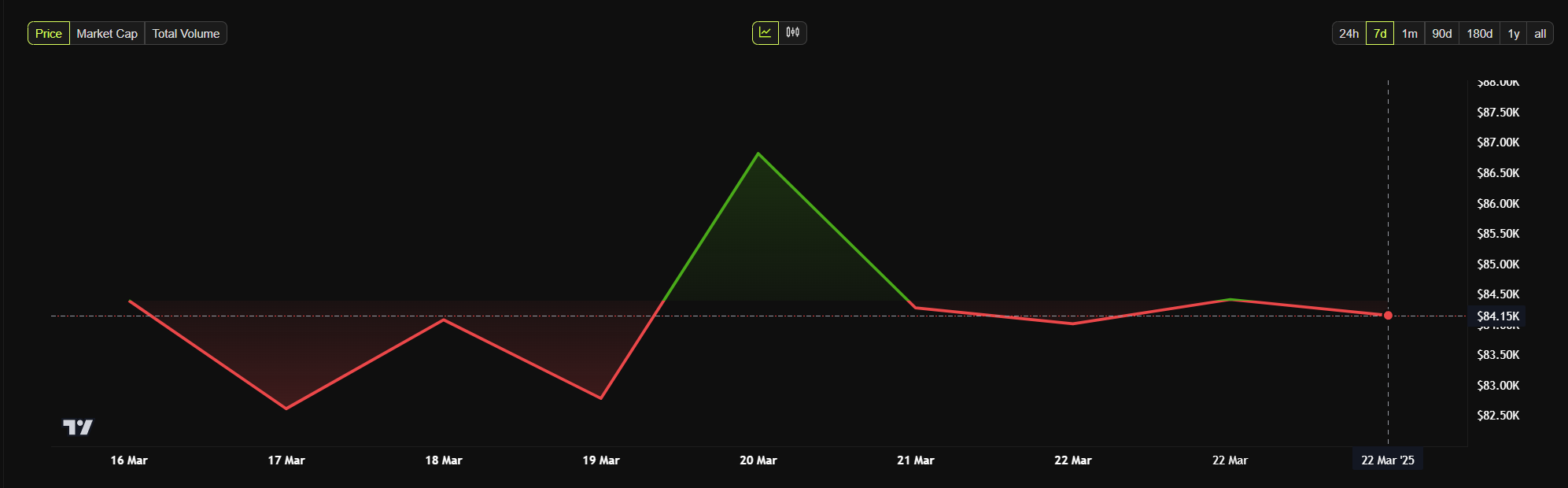

As of this writing, Bitcoin is trading at around $84,148. It is down by a modest 0.46% in the last 24 hours, failing to reflect optimism amid the recent uptick in Bitcoin ETF investments.

Meanwhile, Ethereum ETFs continue to post negative flows, with net inflows in 12 consecutive trading days (over two weeks).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.