Bitcoin sets new record weekly close after breaking above $106K

Key Takeaways

Bitcoin reached a new weekly high, closing above $106,000 and nearing its all-time high.

Institutional and ETF inflows are driving Bitcoin’s price, with corporations increasing their BTC holdings.

Share this article

Bitcoin just ended the week with its strongest close in history, settling above $106,000 after a weekend rally, as shown on Binance’s BTC/USDT chart.

The digital asset pushed as high as $107,000 on Sunday, narrowing the gap to its January all-time high of $109,500 to just 2%.

After testing higher levels, Bitcoin eased to around $104,500 at press time. Still, analysts view the pullback as healthy consolidation amid rising institutional flows and tightening market supply, suggesting continued upward momentum in the near term.

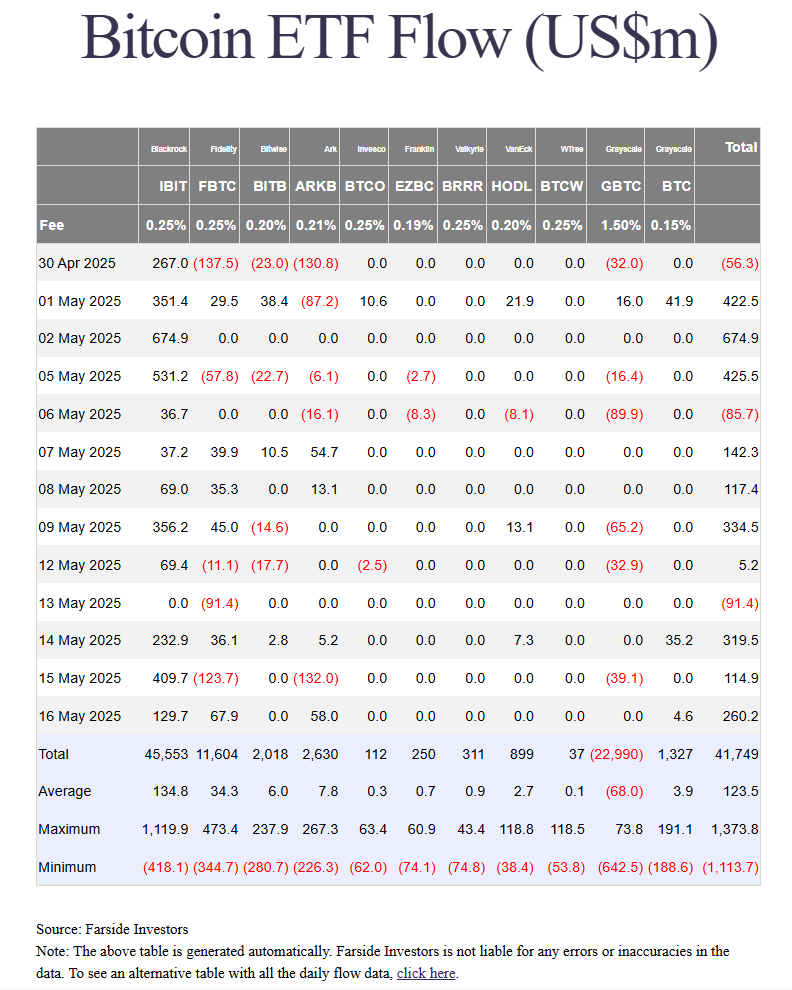

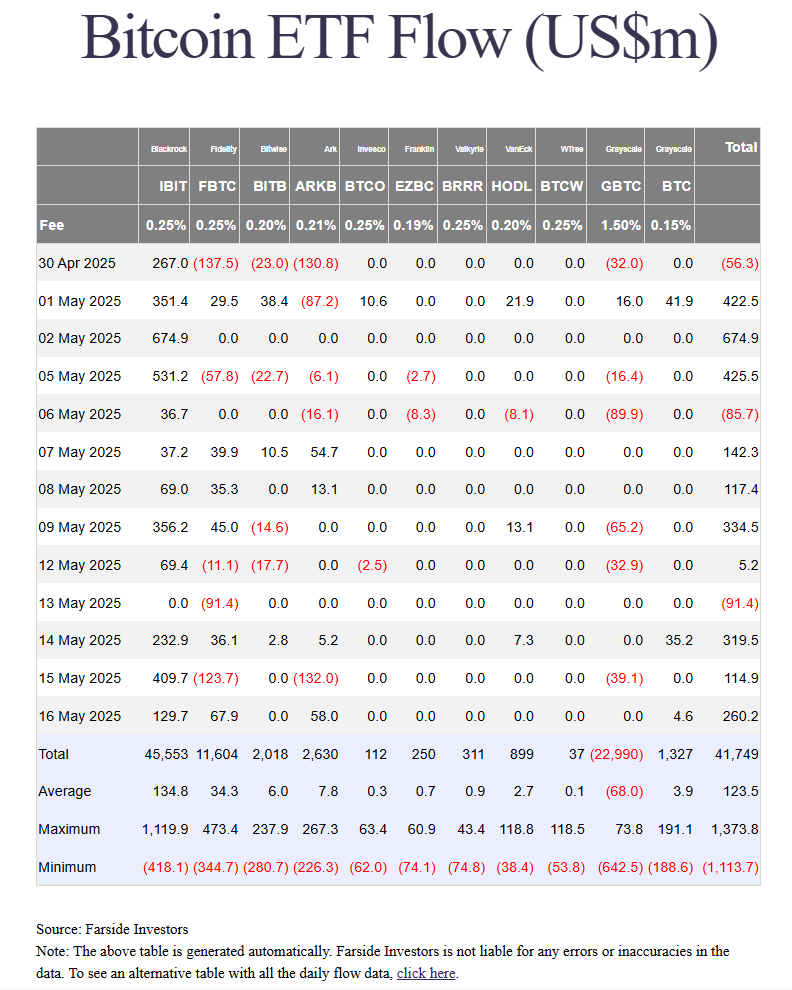

Investor appetite for Bitcoin investment products stays robust. US-listed spot Bitcoin ETFs recorded net inflows of $608 million, building on strong momentum from the previous week, per Farside Investors.

BlackRock’s iShares Bitcoin Trust topped the leaderboard, pulling in more than $840 million, more than the combined net inflows of the rest of the market.

“This is not a melt-up—it’s a structurally supported move,” said analysts at Bitfinex in a comment on Bitcoin’s recent breakout. “As long as ETF and institutional flows persist and macro stays stable, dips are likely to be brief and bought aggressively. The path of least resistance remains higher.”

Corporate demand for Bitcoin also remains strong and steady. On Monday, Strategy, the largest corporate holder of BTC, announced the acquisition of an additional 13,390 BTC for approximately $1.3 billion, bringing its total holdings to 568,840 BTC.

The company’s aggressive accumulation strategy continues to set the pace for institutional adoption.

A growing number of new and existing companies have either adopted Bitcoin or announced plans to hold it as a strategic reserve asset, many of whom are expected to continue purchasing BTC in the months ahead.

Meanwhile, the global race among nations to establish sovereign Bitcoin reserves is also anticipated to accelerate, further tightening supply in the years ahead.

According to Matt Hougan, Chief Investment Officer at Bitwise, demand is now considerably outpacing supply. With miners projected to produce just 165,000 BTC this year, public companies and ETFs have already acquired more than that.

Hougan sees this structural imbalance as a key driver that could propel Bitcoin beyond $100,000, with $200,000 as the next major target.

Share this article