Bitcoin Drops 10% As Fed Warns of Covid-Level Recession

Bitcoin turns bearish as its weekend gains completely evaporate. Negative momentum was briefly halted thanks to Trump’s Crypto Reserve announcement, but the underlying macroeconomic problems remain.

Trump’s tariffs against its closest trading partners are still set to go through, and the Federal Reserve is predicting the worst decline in US GDP since the pandemic began. A broader recession will also hurt the crypto industry.

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

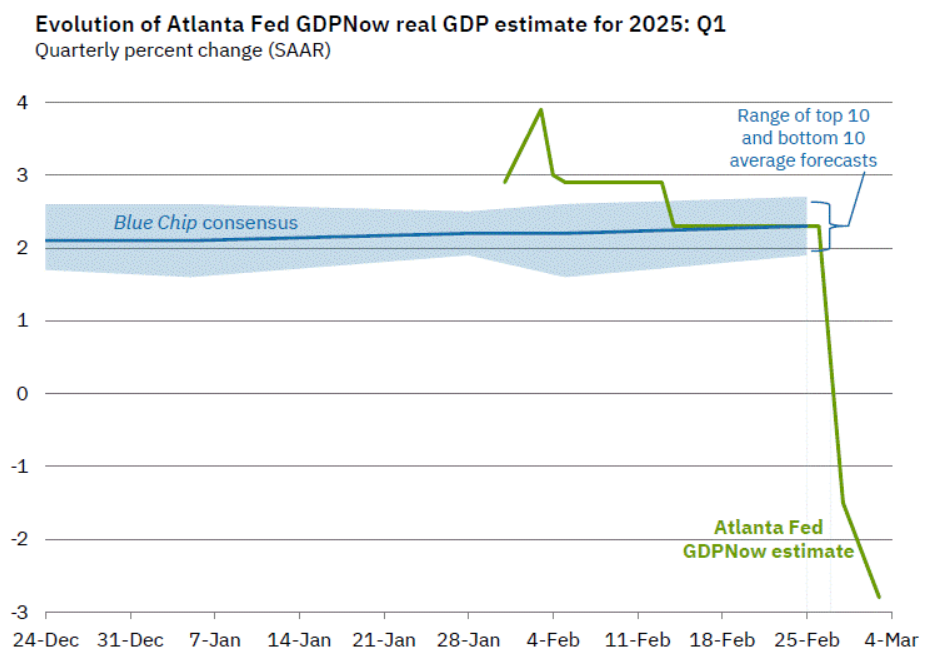

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Macroeconomic Factors Don’t Look Good for Crypto

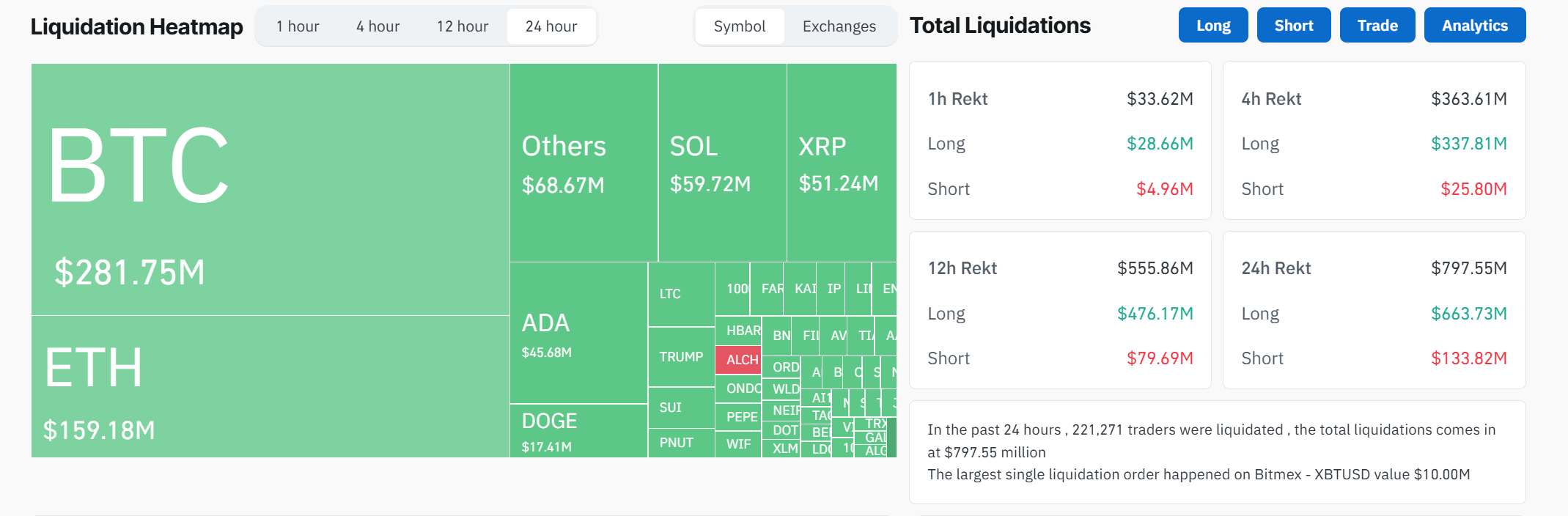

The US economy hasn’t shrunk that much since the early days of the Covid-19 pandemic five years ago. These macroeconomic factors are a significant signal that Bitcoin might turn bearish in the short term. In fact, market liquidations have hit nearly $800 million today.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

“Trump: no room left for deal on tariffs on Mexico, Canada. [He] reiterates plan to double China tariff from 10% to 20%,” claimed Walter Bloomberg via social media.

In other words, macroeconomic factors are largely driving market sentiment in the crypto industry. Since the Bitcoin ETFs were approved, crypto has been well-integrated into traditional finance.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.