World’s first XRP spot ETF to debut on Brazil’s leading stock exchange

Key Takeaways

Hashdex received approval to launch the first XRP ETF in Brazil.

XRP ranks as the third-largest digital asset by market cap.

Share this article

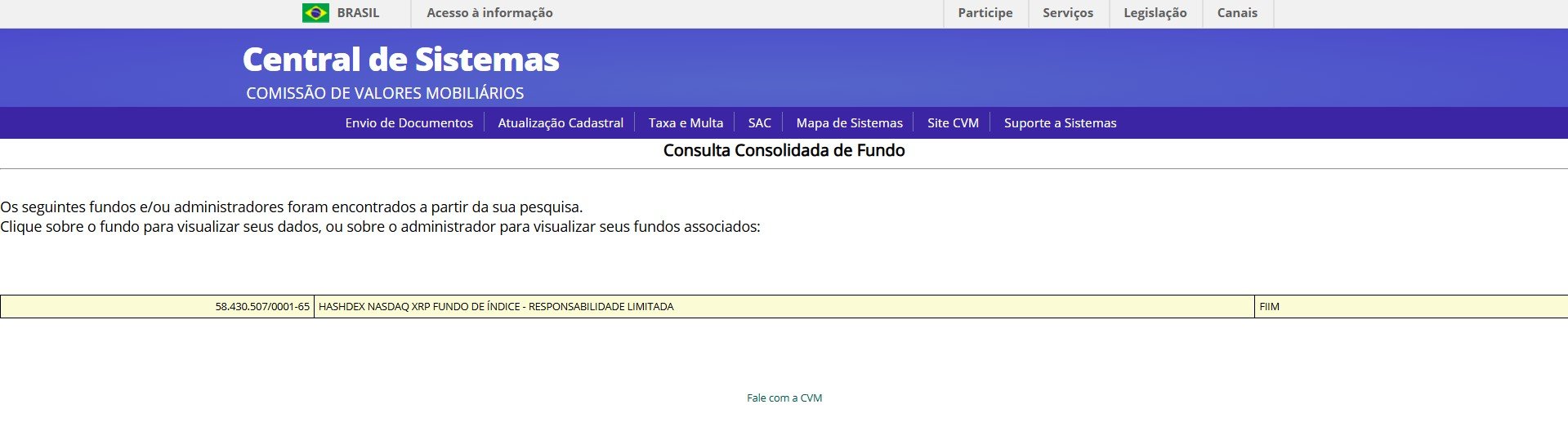

Brazil’s Securities and Exchange Commission (CVM) has approved the world’s first exchange-traded fund that directly holds XRP, Ripple’s native coin, from Hashdex, as shown in the database of the CVM and first reported by Portal do Bitcoin.

The newly approved ETF, called “the Hashdex NASDAQ XRP Index Fund,” is expected to launch on Brazil’s main stock exchange B3. The fund’s official launch date and trading details are yet to be announced. However, Hashdex has confirmed approval and indicated it will provide trading details soon.

The fund was officially established on December 10, 2024, according to information released by the CVM. Major financial services firm Genial Investimentos will serve as the fund’s administrator.

“XRP is a natural choice for an ETF due to its real-world utility, growing institutional demand, and its overall market cap,” said Silvio Pegado, managing director of Ripple in Latin America.

According to CoinGecko data, XRP currently ranks as the world’s third-largest crypto asset with a market cap of $152 billion, trailing only Bitcoin and Ethereum.

Hashdex, an established asset manager focusing on crypto investment products, has already introduced several crypto ETFs in Brazil and in the US.

Last August, the firm was granted approval to launch the Hashdex Nasdaq Solana Index Fund, an investment product that offers investors exposure to Solana. Hashdex also provides funds tied to Bitcoin and Ethereum.

“The approval of the first XRP ETF by the CVM demonstrates Brazil’s visionary approach to crypto markets and financial advancements,” Pegado added. “Through regulation and public consultations, Brazil continues to position itself as a country open to innovation, and we expect it to be central to more pioneering advancements in the crypto sector in the future.”

While Brazil has embraced crypto ETFs, the US has been more hesitant, even with recent Bitcoin and Ethereum ETF approvals. However, the regulatory shift under the new administration could pave the way for more crypto ETFs to gain approval.

JP Morgan predicts that spot Solana and XRP ETFs could draw up to $14 billion in investments during their first 12 months if approved by the SEC.

Share this article