DOGE Whales Acquire 410 Million DOGE as Buy Signal Emerges

Dogecoin’s large investors, often called “whales,” have ramped up their holdings over the past week. On-chain data suggests that the leading meme coin is undervalued, presenting a buying opportunity for those looking to trade against current market trends.

With increasing whale accumulation, DOGE could be poised for a near-term rebound. This analysis explores why.

Dogecoin Whales Are Back in the Game

In the past week, Dogecoin whales holding between 10,000,000 and 100,000,000 DOGE have accumulated 410 million DOGE, valued at $140 million. Currently, this group of whales collectively holds 22.54 billion DOGE — their highest holdings level since February 2016.

When the large holders of an asset increase their coin accumulation, it signifies confidence in its near-term potential. This buying activity reduces the circulating supply, potentially creating scarcity and driving up prices. Moreover, whale accumulation like this attracts retail investors, amplifying demand and supporting a bullish price trend.

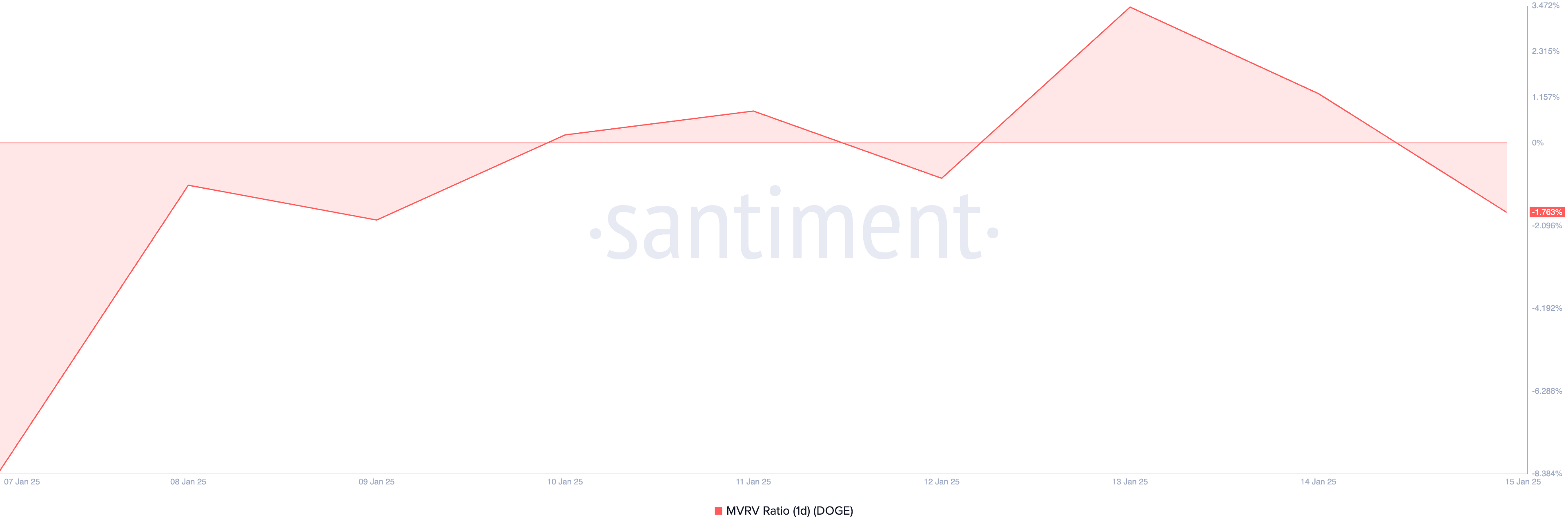

The reason behind the recent spike in DOGE whale accumulation is clear. Readings from its negative market value to realized value (MVRV) ratio suggest that the meme coin is currently undervalued, presenting a prime buying opportunity for those looking to take advantage of the market trend.

As of this writing, the token’s one-day MVRV ratio is -1.76. This metric measures whether an asset is undervalued or overvalued.

Negative MVRV ratios such as this historically represent a buying signal. They indicate the asset is being traded below its historical acquisition cost and may be due for a rebound. Hence, they offer a good buying opportunity for those looking to “buy the dip” and sell at a profit.

DOGE Price Prediction: Accumulation Could Propel Coin to $0.48

On the daily chart, DOGE’s Chaikin Money Flow (CMF) reflects the rising accumulation. As of this writing, the momentum indicator is in an upward trend at 0.03.

When an asset’s CMF is positive, it indicates buying pressure in the market, with more money flowing into the asset than out. This suggests strong investor confidence and is a bullish signal for price movement.

Hence, if DOGE whales continue their accumulation, it could drive the meme coin’s price to $0.48. On the other hand, if selloffs resume, its price could fall to $0.29.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.