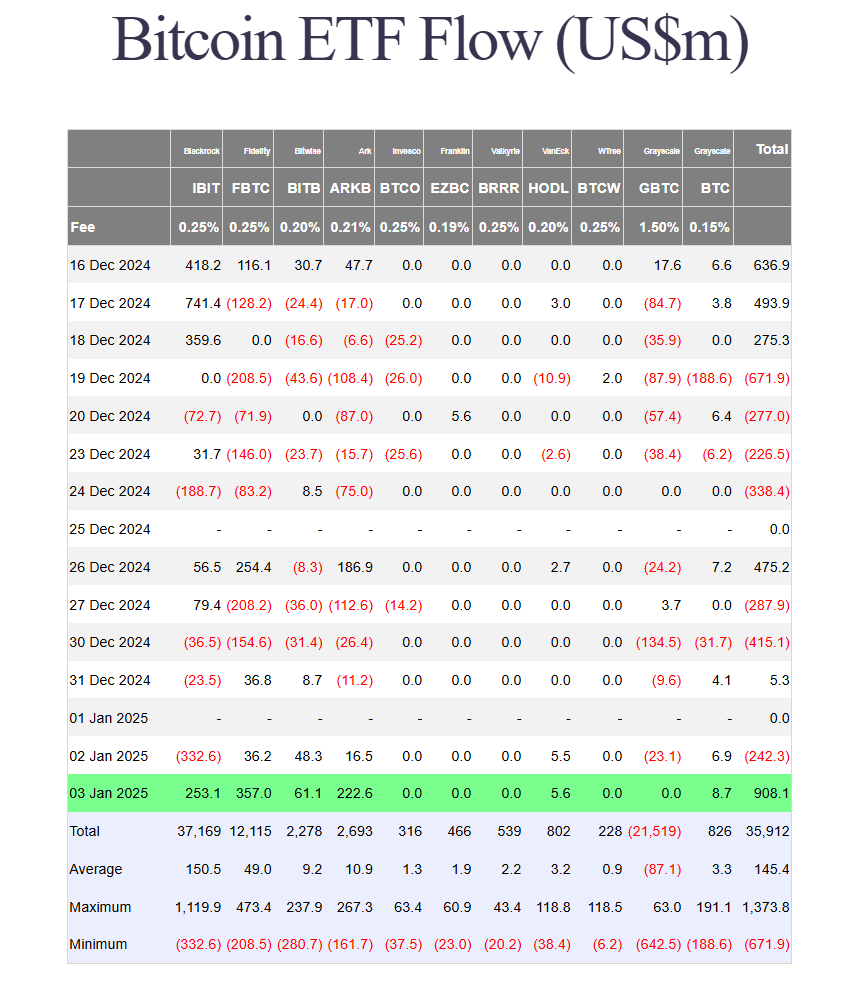

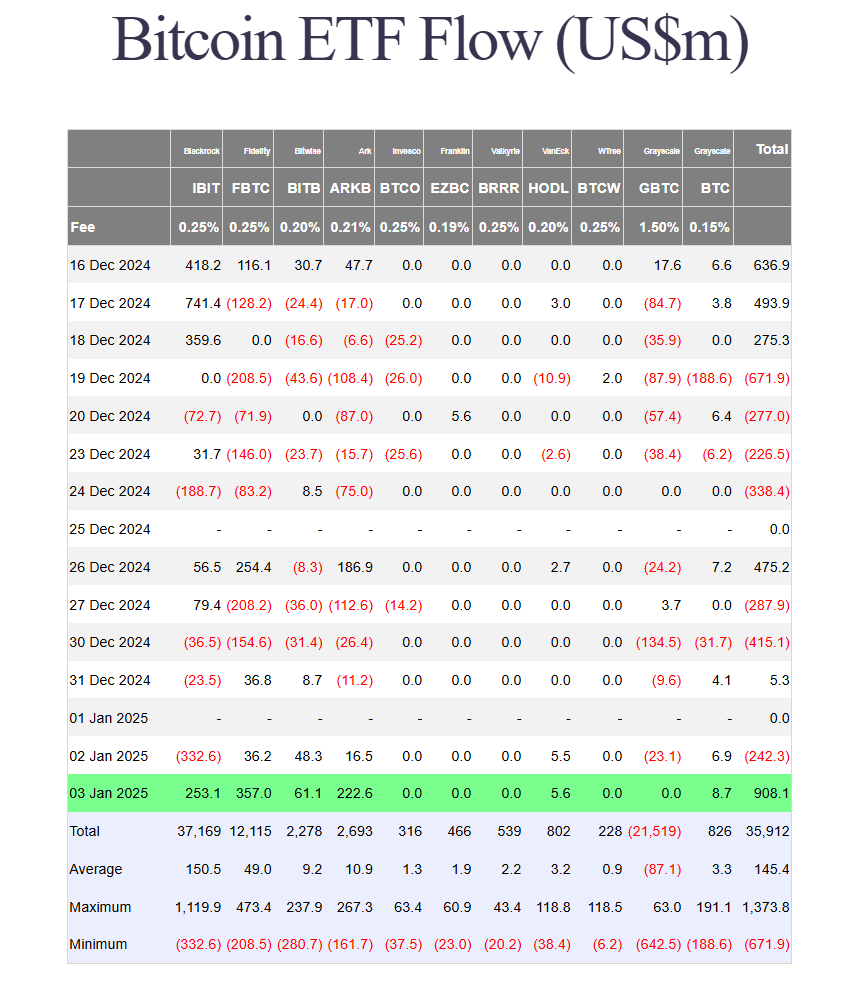

US Bitcoin ETFs draw $908 million daily inflows

Key Takeaways

US Bitcoin ETFs recorded $908 million in net inflows—a rebound from the previous day’s outflow.

Fidelity’s Bitcoin Fund led net inflows, with significant contributions from BlackRock and ARK Invest funds.

Share this article

US spot Bitcoin ETFs raked in $908 million in net inflows on Friday, rebounding from Thursday’s $242 million outflow, according to data from Farside Investors.

BlackRock’s iShares Bitcoin Trust (IBIT) netted $253 million, ending a three-day negative streak that saw $392 million in losses. The fund’s total net inflows recovered to $37 million, with holdings of 548,506 Bitcoin valued at $53.4 billion.

Fidelity’s Bitcoin Fund (FBTC) led Friday’s gains with $357 million in net inflows—one of its strongest daily performances since launch. FBTC has accumulated over $12 billion in new investments as of January 3.

The ARKB fund, managed by ARK Invest and 21Shares, recorded $222 million in net inflows. Bitwise, Grayscale (BTC), and VanEck funds also posted gains, while other ETF providers reported no flows.

Bitcoin reclaims the $98,000 mark

Bitcoin reached $98,900 on Friday, surpassing $98,000 for the first time since December 26, CoinGecko data shows. The digital asset currently trades above $98,000, showing a 4% increase over the past week.

Analysts predict a bullish year for Bitcoin, driven by growing institutional and national adoption.

Galaxy Research forecasts five Nasdaq 100 companies and five nations will add Bitcoin to their balance sheets in 2025 to diversify their portfolio and meet their trade settlement needs. The firm also projects US spot Bitcoin ETFs will reach $250 billion in assets under management.

Jan van Eck, CEO of VanEck, recommends that investors increase their holdings in Bitcoin and gold through 2025, as these assets offer valuable protection against inflation, fiscal uncertainty, and global de-dollarization trends.

Van Eck projects Bitcoin could reach $150,000 to $170,000. This stance is supported by other financial analysts and institutions recognizing Bitcoin’s potential to hedge against financial risks.

Share this article